To raise interest from investors, you should demonstrate a validated market hypothesis.

Pitching your startup in front of investors can be intimidating. Here are some insights that we believe in and would like to share with founders looking to raise money. Having a well-refined elevator pitch can be as important as the business concept itself. And remember that your idea doesn’t need to be brilliant to build a successful startup, it’s just a matter of good execution.

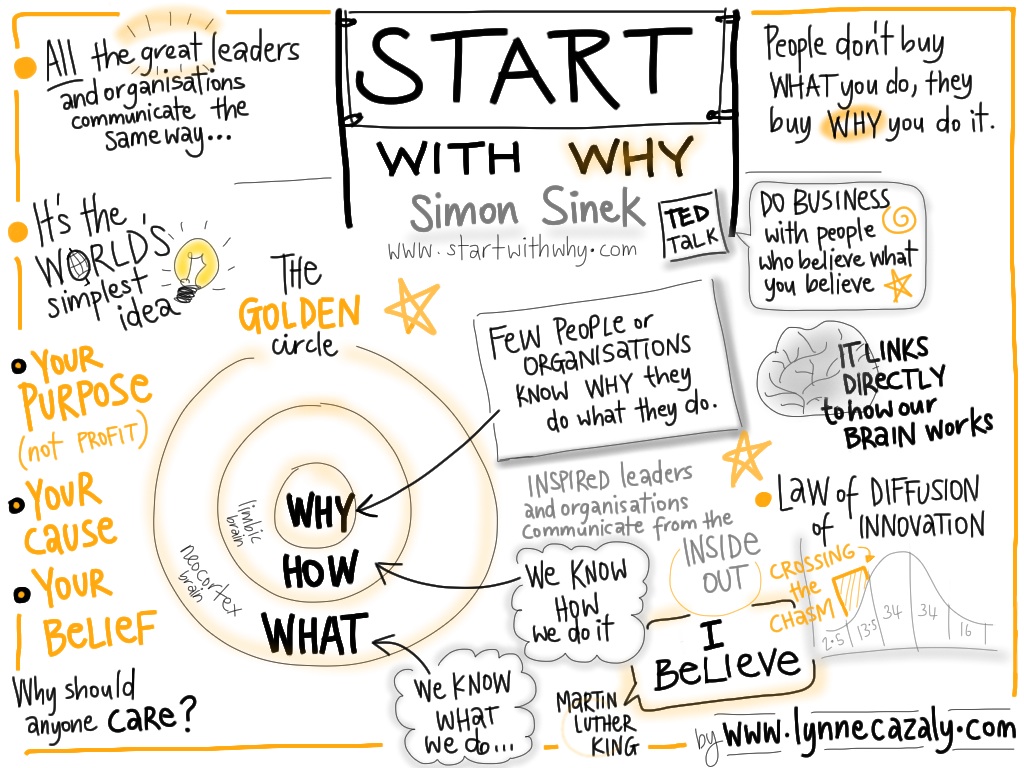

Start with Why

One of the most powerful frameworks is “Start With Why”, saying that people usually don’t care How you do it or What you do, but people care Why you do it. “Why” is the most transformational place to start as it is the place of purpose for a company.

Starting with “Why” helps your investors understand what is your purpose, what is your cause, and what is your belief as a founder.

Simon says: Start With Why by Lynne Cazaly

Elevator pitch

When pitching their startup, many founders start with the solution, which is the wrong way to start. First, you should focus on the problem. If you already have an MVP built, then investors look for traction. First, you understand the problem, then you come up with a hypothetical solution for that, and then you ask yourself: “Do we have any validation?” “Does this solution solve the problem?” “Do we have product-market fit?” The only way to get to know the answer is by looking at the numbers and traction: Do you have monthly recurring revenue? Are you growing fast enough: weekly or monthly? How much are you spending on marketing? How much is your Customer Lifetime Value?

What do investors want?

You could have an awesome solution to a huge problem, but if you can’t monetize it, that’s not where the investors want to invest their money. Investors want to see your growth by numbers and percentages: How big is your market size? Where will it go in the next few years? Investors want to know what do you do with the money, what’s your plan. If you get a 5 million dollar investment, how do you plan to spend it, how long is your runway? You need to have a specific plan like “These are the people I need to hire”, “This is the marketing cost”, “Product engineering costs”, and it should make sense. If you spend the money on product development and growth, that’s what they want to see.

Know your competitors

You need to show that your product is 10X better than what most of the customers are using today. One important thing to understand is that you don’t have to be 10X better than your immediate competitor or another startup solving the same problem as you are. You’re actually competing with the big whales on the market. For example, Wise isn’t competing with other money transfer startups. They are competing with the big banks that have 90% of the market today.

The team is important

You should be able to demonstrate that you have the right people on the team to make the startup happen. You definitely need a CTO if you’re building a tech company without any technical background and trying to attract investments. You should have very strong domain expertise and demonstrate that you have been in this industry for 5-10 years, and you know all the ins and outs of it.

These are just some of the points that we pay attention to before we start working with startups that Producement helps to scale. And if you want to scale with us, let’s have a chat and see what impact we can have together.